5 Quick Tips before Sending Money from Japan

Foreigners living in Japan had a more complicated time sending money to their loved ones in their home country compared today. A few years ago, people had to register via international banks to send money to their families, which cost higher charges and was a bit time-consuming. But, with the help of technology and remittance centers, yen can be sent via bank transfer, pick-up centers in the home country, or even e-wallets in just one day!

Top Tips when Sending Money

Now here are some tips you can do before considering sending money from Japan

1. Exchange Rates

It’s obvious that the first thing you consider when sending money is the RATE. All companies have fluctuating rates from time to time, and no one can predict a better rate unless you study FOREX then you might have a gist on it. But for most foreigners, the best you can do is find a trusted remittance center and observe when they change their rates in a day and then decide whether the rate benefits you or you shall wait another day for a better rate. Most companies update their rates on their websites, mobile applications, and social media platforms like Facebook and Instagram.

2. Hidden Charges

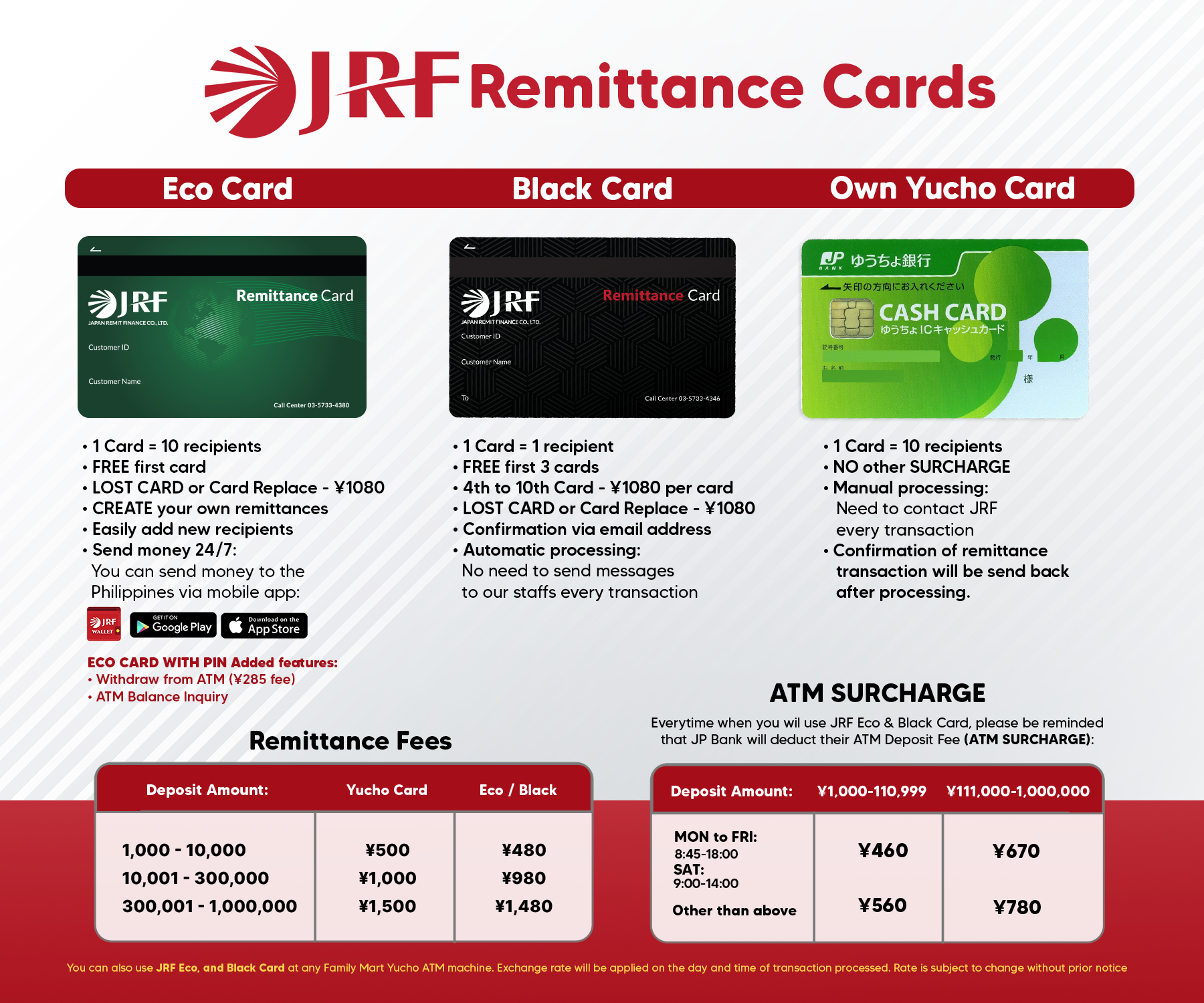

Most remittance companies market their “lowest charges” but have hidden fees once you register and try to remit. Make sure to check their website and try the simulation or calculator section where you can get the amount needed depending on the current rate like the example below.

This calculation varies on how you deposit the money, how much you will send, the current rate, and the payment method. Do not get fooled by the cheapest fees marketed because those are just remittance fees and ATM charges are not yet included. ATM charges are cheaper during daytime and on weekdays, so you better watch out for that. Also, the ATM charges vary on the amount you deposit/transfer, the bigger the amount, the higher the charges. It is recommended to contact their customer service and ask for the most favorable or cheapest way to process your remittance.

3.Promos, Discounts, and Freebies

Promos will never go out of style and it`s better not to miss that chance. Most remittance companies have promos like referrals, birthdays, or raffle draws. Take advantage of your registration or membership and you might have a zero-yen charge for your next remittance! You can also get free remittance cards and choose the best one fit for your availability in sending your remittance.

4.Mobile Application

Technology is playing a huge part in finance these days, especially in international services like online remittances. As a customer, it can be beneficial to download a mobile application provided by your remittance company for easier access to your transaction history, online receipts, and list of beneficiaries. If you want to apply for an annual tax refund in your local area, you can also access a free remittance certificate using the mobile application. The most convenient part of it? You can send money anytime and anywhere online with just your phone and internet.

5.Customer Service

If you want to rest and save time from all the research mentioned in tips 1 to 4, one alternative is to find a remittance company with great customer service. This will save you time since the staff will streamline everything you want to know.

These are some questions you can ask the staff to further help you decide when, where, and how to remit your money.

- How to register and how long would it take?

- How long will it take to receive the money?

- How much is the actual amount that can be received after the charges?

- How much is the transaction limit per day and per month?

- What are other options to remit with cheaper charges?

- What time can I contact customer service?

- Can I cancel the remittance once processed in case of an emergency?

- How can I be sure that my remittance is secured? These might be a lot of questions to process but knowing more will save you more. And one more tip- always check customer reviews! Good luck with your remittance journey.

Related Posts

सबैमा हार्दिक धन्यवाद आभार व्यक्त गर्दछौ ॥

Celebrating Christmas with the JRF Family

JRF Stands Out at the Philippine Festival 2024!

Most Read Article

Fast, Simple and Secured way of remittance. You can

send money anytime and on the go

![]()

![]()